UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant S

Filed by a Party other than the Registrant £

Check the appropriate box:

| £ | Preliminary Proxy Statement |

| £ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| S | Definitive Proxy Statement |

| £ | Definitive Additional Materials |

| £ | Soliciting Material under Rule 14a-12 |

| MidSouth Bancorp, Inc. |

| (Name of Registrant as Specified In Its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| £ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| £ | Fee paid previously with preliminary materials: |

| £ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

MIDSOUTH BANCORP, INC.

102 Versailles Boulevard

Versailles Centre

Lafayette, Louisiana 70501

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

Lafayette, Louisiana

April 22, 201113, 2012

We will hold our annual shareholders meeting on Wednesday, May 25, 2011,23, 2012, at 1:00 p.m., local time, at our corporate offices, 102 Versailles Boulevard, Lafayette, Louisiana 70501, where we will vote upon:

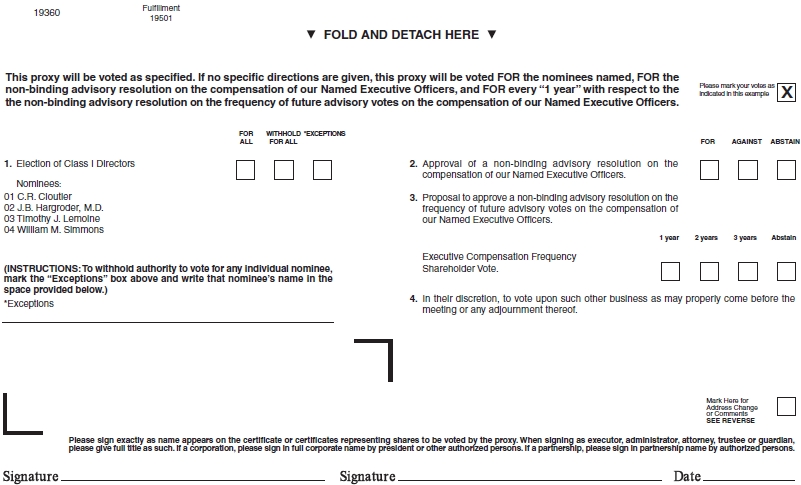

1. the election of four directors for a term to expire in 2014; | 1. | the election of four directors for a term to expire in 2015; |

2. | 2. | a proposal to approve a non-binding advisory resolution on the compensation of our named executive officers; | |

| | 3. | a proposal to amendapprove a non-binding advisory resolution on the frequency of future advisory votes on the compensation of our Amendednamed executive officers; and Restated Articles of Incorporation (the “Articles of Incorporation”) to eliminate the ability of Directors to vote by Proxy at Board Meetings; |

| | 4. | a proposal to amend our Articles of Incorporation to modifysuch other matters as may properly come before the procedures for shareholder nominations of Directors; andmeeting or any adjournments. |

5. such other matters as may properly come before the meeting or any adjournments.

The items of business listed above are more fully described in the Proxy Statement accompanying this notice. If you were a holder of our common stock on March 31, 2011,15, 2012, you are entitled to notice of and to vote at the meeting.

Your vote is important. Whether or not you expect to attend the annual meeting, it is important that your shares be represented and voted at the meeting.

PLEASE MARK, SIGN, DATE, AND PROMPTLY RETURN YOUR PROXY BY FOLLOWING THE INSTRUCTIONS FOR VOTING BY MAIL, OR SUBMIT YOUR PROXY BY FOLLOWING THE INSTRUCTIONS FOR VOTING BY PHONE OR ON THE INTERNET. THANK YOU.

| | BY ORDER OF THE BOARD OF DIRECTORS |

| |

| | | /s//s/ R. Glenn Pumpelly |

| | | R. Glenn Pumpelly |

| | | Secretary to the Board |

Internet Availability of Proxy Materials

This year, we are using for the first time a U.S. Securities and Exchange Commission rule that allows us to furnish proxy materials to shareholders over the Internet. As a result, beginning on or about April 13, 2012, we sent by mail a Notice of Internet Availability of Proxy Materials, containing instructions on how to access our proxy materials, including our Proxy Statement and 2011 Annual Report, over the Internet and how to vote. Internet availability of our proxy materials is designed to expedite receipt by shareholders and lower the cost and environmental impact of the annual meeting. However, if you received such a notice and would prefer to receive paper copies of the proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials.

We provided some of our shareholders with paper copies of the proxy materials instead of, or in addition to (by separate mailing), the Notice of Internet Availability. If you have received paper copies of the proxy materials and would prefer to receive only electronic copies of such materials, please contact Shaleen B. Pellerin at (337) 593-3011, or write to her at 102 Versailles Boulevard, Versailles Center, Lafayette, Louisiana 70501, if your shares are registered in your name, or by calling your bank, broker or other nominee.

If you hold our stock through more than one account, you may receive multiple copies of these proxy materials and will have to follow the instructions of each in order to vote all of your shares of our stock.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR OUR ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 23, 2012.

Our Proxy Statement for the 2012 Annual Meeting and our Annual Report to shareholders for the year ended December 31, 2011 are available at http://bnymellon.mobular.net/bnymellon/msl.

MIDSOUTH BANCORP, INC.

102 Versailles Boulevard

Versailles Centre

Lafayette, Louisiana 70501

PROXY STATEMENT

This Proxy Statement is being sent to our shareholders to solicit on behalf of our Board of Directors proxies for use at our annual shareholders meeting to be held on Wednesday, May 25, 2011,23, 2012, at 1:00 p.m. at our corporate offices, located at 102 Versailles Boulevard, Versailles Center, Lafayette, Louisiana and at any adjournments thereof. Directions to attend the annual meeting where you can vote in person can be found on our website at www.midsouthbank.com or may be obtained by calling Shaleen B. Pellerin at (337) 593-3011. This Statement is first being mailed to shareholders on or about April 22, 2011.13, 2012. As used in this Proxy Statement, the terms, “we,” “us,” “our” and the “Company” refer to MidSouth Bancorp, Inc., and the terms “MidSouth Bank” and the “Bank” refer to our wholly owned subsidiary, MidSouth Bank, N.A.

Only holders of our common stock as of close of business on March 31, 2011,15, 2012, are entitled to notice of and to vote at the Meeting. On that date we had outstanding 9, 880,74310,631,830 shares of stock, each of which is entitled to one vote.

The presence, in person or by proxy, of holders of a majority of our common stock is needed to make up a quorum for the Annual Meeting. Abstentions will be treated as present for purposes of determining a quorum. In addition, shares held by a broker as nominee (i.e., in “street name”) that are represented by proxies at the Annual Meeting, but that the broker fails to vote on one or more matters as a result of incomplete instructions from a beneficial owner of the shares (“broker non-votes”), will also be treated as present for quorum purposes.

The proposal to elect directors to serve as members of our Board of Directors requires the affirmative vote of a plurality of the shares of common stock present, in person, or represented by proxy at the Annual Meeting. “Plurality” means that the individuals who receive the largest number of votes are elected as directors, up to the maximum number of directors to be chosen. As a result, abstentions and broker non-votes will have no effect on this proposal. Approval of our proposalThe proposals to approve a non-binding resolution regarding the compensation of our named executive officers (the “Named Executive Officers” or “NEOs”) requires, often called a "say-on-pay" proposal, and the proposal to determine, on an advisory basis, the frequency of future say-on-pay proposals, both require a majority of the votes cast at the Annual Meeting. Accordingly, abstention and broker non-votes will not count as a vote in favor of or against this proposal. The proposals to amend our Articles of Incorporation to (1) eliminate the ability of Directors to vote by proxy at board meetings and (2) to modify the procedures for shareholder nominations of Directors both require the affirmative vote of a majority of the total number of shares that are present, in person or by proxy. As a result, abstentions and broker non-votes will count as votes against either ofhave no effect on these proposals.

Each of these proposals was unanimously recommended by our Board of Directors. If any proposal comes before the Annual Meeting that has not been recommended by a majority of our “Continuing Directors,” as defined in our Articles of Incorporation, then approval of any such proposal requires the affirmative vote of at least 80% of the “Total Voting Power” of the Company, as defined in our Articles of Incorporation.

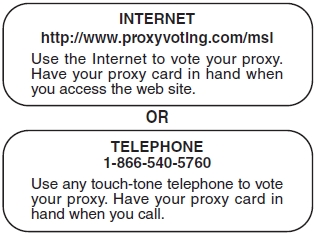

You may vote your shares by any one of the following methods:

| · | By mail: Mark your votes, sign and return the proxy card or vote instruction form in the enclosed postage paid envelope. |

| · | By Internet: Log onto the website indicated on your enclosed proxy card or vote instruction form. |

| · | You may attend the Annual Meeting in person and use a ballot to cast your vote. |

If you vote by the Internet, you do not need to send in your proxy card or vote instruction form. The deadline for Internet voting will be 11:59 p.m., EasternCentral Time, on May 24, 2011.22, 2012. If your shares are held in street name, and you wish to vote your shares at the Annual Meeting, you will need to contact your bank, broker or other nominee to obtain a legal proxy form that you must bring with you to the meeting to exchange for a ballot.

All proxies received in the enclosed form will be voted as you specify. If you sign and return your proxy form but do not specify how to vote your shares, your shares will be voted for the election of the personsdirector nominees named herein that have been recommended by the Board of Directors for election, for the proposal to approve a non-binding advisory resolution on our compensation of our NEOs and for an annual say-on-pay vote with respect to the two amendmentsproposal to approve a non-binding advisory resolution on the frequency of future advisory votes on the compensation of our Articles of Incorporation.NEOs. We do not know of anything else to be presented at the Meeting other than the election of directors and the approval of the other proposals described in this Proxy Statement, but if anything else does come up, the persons named in the enclosed proxy will vote the shares covered by the proxy as determined by the Board of Directors.

You have the right to change and revoke your proxy at any time before the Annual Meeting. If you hold your shares in your name, you may contact our Corporate Secretary and request that another proxy card be sent to you. Alternatively, you may use the Internet to re-vote your shares, even if you mailed your proxy card or previously voted using the Internet. The latest-dated, properly completed proxy that you submit, whether through the Internet or by mail will count as your vote. Please note that if you re-vote your shares by mail, your re-vote will not be effective unless it is received by our Corporate Secretary at the address specified herein prior to the Annual Meeting. If your shares are held in street name, you must contact your broker or other nominee and follow its procedures for changing your vote.

The cost of soliciting proxies will be borne by us. In addition to the mail, proxies may be solicited by our directors and officers through personal interview, telephone, telegraph, facsimile, internet and e-mail. Banks, brokerage houses and other nominees or fiduciaries may be asked to forward these materials to their principals and to get authority to execute proxies, and we will, upon request, reimburse them for their expenses in so acting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR OUR ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 25, 2011.

Our Proxy Statement for the 2011 Annual Meeting and our Annual Report to shareholders for the year ended December 31, 2010 is available at http://bnymellon.mobular.net/bnymellon/msl.

ANNUAL MEETING BUSINESS

Item 1. Election of Directors

Our Articles of Incorporation provide for three classes of directors, with one class to be elected at each annual meeting for a three-year term. At the Annual Meeting, four Class IIII Directors will be elected to serve until the 20142015 Annual Meeting or their earlier resignation, removal or death and until their successors are elected and qualified.

Unless you withhold authority, the persons named in the enclosed proxy will vote the shares covered by the proxies received by them for the election of the four Class IIII director nominees named below that have been nominated and recommended by the Board. The Board of Directors has no reason to believe that any of the persons nominated and recommended by the Board is not available or will not serve if elected. If for any reason a nominee becomes unavailable for election, the Board of Directors may designate substitute nominees, in which event the shares represented by proxies returned to us will be voted for such substitute nominees, unless an instruction to the contrary is indicated on the proxy.

Other than the Board of Directors, only shareholders who have complied with the procedures of Article IV (H) of our Articles of Incorporationdescribed below under "Corporate Governance – Director Nomination" may nominate a person for election. Under the current provisions set forth in Article IV(H), to do so you must have given us written notice by the applicable date, of the following:

(1) as to each person whom you propose to nominate:

(a) his or her name, age, business address, residence address, principal occupation or employment,

(b) the number of shares of our stock of which the person is the beneficial owner, and

(c) any other information relating to the person that would be required to be disclosed in solicitations of proxies for the election of directors by Regulation 14A under the Securities Exchange Act of 1934; and

(2) as to you:

(a) your name and address,

(b) the number of shares of our stock of which you are the beneficial owner, and

(c) a description of any agreements, arrangements or relationships between you and each person you want to nominate.

An inspector, not affiliated with us, appointed by our Corporate Secretary, will determine whether the notice provisions were met. If they determine that you have not complied with Article IV (H), your nomination will be disregarded.

Please be aware that, as described below under Item 4, we are proposing to amend Article IV(H) to modify these procedures. If Item 4 is approved, shareholders will be required to comply with the revised provisions described in Item 4 in order to nominate a person for election as a director.

As described below, we received two shareholder nominations for director in connection with this Annual Meeting.

The following table gives information as of March 31, 2011,15, 2012, about each person nominated by the Board for election as a director and each director whose term will continue after the Annual Meeting, including information regarding why we believe such person should serve as a director of the Company. Unless otherwise indicated, each person has had the principal occupation shown for at least the past five years. No shareholder nominations for the election of directors were received in connection with the Annual Meeting.

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”“FOR” THE ELECTION OF EACH OF THE FOLLOWING NOMINEES.

Director Nominees for terms to expire in 2014 (Class III Directors) |

Name | Age | Principal Occupation, Background and Qualifications |

James R. Davis, Jr.

Director since 1991

| 58 | President, Quigley & Company, L.L.C.; Chairman of our Audit Committee

Mr. Davis’ professional experience as a successful entrepreneur provides the Board with business insight and analytical skills that are necessary to direct the Company’s affairs in this difficult and highly regulated environment.

|

Milton B. Kidd, III, O.D.

Director since 1996

| 62 | Optometrist, Kidd & Associates, L.L.C.

Dr. Kidd’s professional and entrepreneurial experience in addition to his business and family contacts in the banking community are assets to the Board.

|

R. Glenn Pumpelly

Director since 2007

| 52 | President, GP Holdings of Louisiana, L.L.C. and Pumpelly Tire, L.L.C.; Our Secretary to the Board

Mr. Pumpelly’s professional experience as a successful owner of a petroleum marketing company as well as his involvement on various boards provides the Board with business insight and analytical skills that are necessary to direct the Company’s affairs in this difficult environment.

|

Gerald G. “Jerry” Reaux, Jr. | 50 | Chief Operating Officer of MidSouth Bank

Mr. Reaux’s professional experience includes serving as Vice Chairman and Chief Executive Officer of Tri-Parish Bancshares, Ltd from 2004 until February, 2011. His 29 years banking service includes serving as CEO at a publicly traded bank, as well as at the local and national level all of which are assets to the board. His knowledge of the communities we serve and his long-standing involvement will bring more depth to our board.

|

Directors whose terms expire in 2012Directors Nominees for terms to expire in 2015 (Class I Directors) |

| Name | Age | Principal Occupation, Background and Qualifications |

C. R. Cloutier Director since 1984 | 6465 | Our President and C.E.O., and President and C.E.O. of our subsidiary, MidSouth Bank, N.A. Mr. Cloutier’s experience in the banking industry, service on the Federal Reserve Board, and his extensive contacts and involvement within the communities in which we operate and on the national scene are valuable to leading the Board throughBoard. Mr. Cloutier is the current economic environment.father of Troy M. Cloutier, the Bank’s Chief Banking Officer. |

| | |

J. B. Hargroder, M.D. Director since 1984 | 8081 | Physician, Retired; Vice Chairman of our BoardRetired Dr. Hargroder’s business experience in the medical field (which is a significant part of the Bank's customer base), his experience in dealing with government regulations, and his familiarity with his community are assets to the board.Board. |

| | |

Timothy J. Lemoine Director since 2007 | 6061 | Independent Construction Consultant Mr. Lemoine’s business experience and knowledge of the construction industry provide valuable insight to the Company and the Board given the significant construction lending done by the Bank. |

| | |

William M. Simmons Director since 1984 | 7778 | Investor, Retired Mr. Simmon’s entrepreneurial and business experience combined with his family contacts within the communities in which we operate are invaluable to the Company.Company and the Board. |

Directors whose terms expire in 2013 (Class II Directors) |

Directors whose terms expire in 2013 (Class II Directors)

| Name | Age | Principal Occupation, Background and Qualifications |

Will Charbonnet, Sr. Director since 1984 | 64 | Our Chairman of the Board; Treasurer and Managing Director of Crossroads Catholic Bookstore (non-profit corporation); Controller of Philadelphia Fresh Foods, L.L.C. Mr. Charbonnet’s financial expertise, business experience and strong analytical skills are helpful to the Board’s ability to direct the affairs of a highly regulated company. |

| | |

Clayton Paul Hilliard Director since 1984 | 8586 | President of Badger Oil Corporation, Convexx Oil and Gas, Inc., and Warlord Oil Corporation; Manager, Uniqard, L.L.C.; Badger Energy, L.L.C. Mr. Hilliard's experience as owner and President of an oil field serviceand gas exploration business provides the Board with insight into the oil and gas industry, which industry comprises a largethe largest portion of the Bank's customers. |

| | |

Joseph V. Tortorice, Jr. Director since 2004 | 6263 | C.E.O., Deli Management, Inc. Mr. Tortorice’s business experience and familiarity with the Texas communitycommunities we serve is valuable in directing the affairs of the Company.Company and providing guidance on such matters to the Board. |

The Company also received nominations from two shareholders for the reelection of Karen L. Hail as a Class III Director with a term expiring at the 2014 annual meeting, which nominations were accepted. As a result, Ms. Hail will also stand for election at the Annual Meeting; however, the Company is not soliciting proxies for the election of Ms. Hail. Effective March 31, 2011, Ms. Hail is no longer employed by the Bank, but will continue to serve as a director until the Annual Meeting. Given her prior service as an employee, if reelected, Ms. Hail would not be deemed “independent” under current NYSE Amex rules.

Director whose terms expire in 2014 (Class III Directors)

| Name | Age | Principal Occupation, Background and Qualifications |

James R. Davis, Jr. Director since 1991 | 59 | President, Quigley & Company, L.L.C.; Chairman of our Audit Committee Mr. Davis’ professional experience as a successful entrepreneur provides the Board with business insight and analytical skills that are necessary to direct the Company’s affairs and provide insight to the Board in this difficult and highly regulated environment. |

| | |

Milton B. Kidd, III, O.D. Director since 1996 | 63 | Optometrist, Kidd & Associates, L.L.C. Dr. Kidd’s professional and entrepreneurial experience in addition to his business and family contacts in the banking community within our Louisiana markets are assets to the Board. |

| | |

R. Glenn Pumpelly Director since 2007 | 53 | President, GP Holdings of Louisiana, L.L.C. and Pumpelly Tire, L.L.C.; Our Secretary to the Board Mr. Pumpelly’s professional experience as a successful owner of a petroleum marketing company as well as his involvement on various boards provides the Board with business insight and analytical skills that are necessary to direct the Company’s affairs and provide insight to the Board in this difficult environment. |

| | |

Gerald G. “Jerry” Reaux, Jr. Director since 2011 | 51 | Vice Chairman of the Board & Chief Operating Officer of MidSouth Bank Mr. Reaux’s joined MidSouth Bank in February, 2011 and was elected to the Board and to the position of Vice Chairman in May 2011. His professional experience includes serving as Vice Chairman and Chief Executive Officer of Tri-Parish Bancshares, Ltd. from 2004 until February, 2011. His 30 years of banking service, including serving as Chairman and CEO of a publicly traded bank holding company, are valuable assets to the Board. |

Item 2. Proposal to Approve a Non-binding Advisory Resolution on the Compensation of our Named Executive Officers

As a result of our participation in the Capital Purchase Program (the “CPP”)Pursuant to Section 14A of the United States DepartmentSecurities Exchange Act of the Treasury’s1934, as amended (the “Treasury”"Exchange Act") Troubled Asset Relief Program (“TARP”), we are subject to the provisionsseeking advisory shareholder approval of the Emergency Economic Stabilization Act of 2008 (“EESA”), which was recently amended by the American Recovery and Reinvestment Act of 2009 (“ARRA”) to provide additional executive compensation requirements.

Per the additional requirements defined by the ARRA, we submit to our shareholders a non-binding resolution to approve the compensation of our NEOs,Named Executive Officers as disclosed in this Proxy Statement, including the Compensation Discussion and Analysis (“CD&A”), the executive compensation tables and the other related disclosure.Statement. Shareholders are encouragedbeing asked to carefully reviewvote on the executive compensation sections of this Proxy Statement outlining the Company’s executive compensation program. Accordingly, the Board of Directors hereby submits for shareholder consideration, thefollowing advisory resolution set forth below, commonly known as a “say-on-pay proposal”:“say-on-pay” proposal:

“Resolved, that the shareholders hereby approve the compensation of our named executive officersNamed Executive Officers as reflected in the Proxy Statement for the Annual Meeting and as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, which disclosure includes the Compensation Discussion and Analysis, the compensation tables and all related material in the Proxy Statement.”

Shareholders are encouraged to carefully review the executive compensation sections of this Proxy Statement outlining the Company’s executive compensation program. The Board of Directors believes that the Company’s compensation policies and procedures are centered on a pay-for-performance culture and are aligned with the long-term interests of shareholders, and, accordingly, recommends a vote in favor of this resolution.

If this resolution is not approved by our shareholders, such a vote shall not be construed as overruling a decision by the Board of Directors or PersonnelCompensation Committee of the Board, nor create or imply any additional fiduciary duty by the Board of Directors or the Personnel Committee, nor shall such a vote be construed to restrict or limit the ability of our shareholders to make proposals for inclusion in proxy materials related to executive compensation. Notwithstanding the foregoing,Compensation Committee. However, while not binding, the Board of Directors and the PersonnelCompensation Committee will consider the non-binding vote of our shareholders on this resolution when reviewing compensation policies and practices in the future.

YOUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”“FOR” THE PROPOSED RESOLUTION ONAPPROVING THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

Item 3. Proposal to Amend Our Articlesapprove a Non-binding Advisory Resolution on the Frequency of Incorporation to EliminateFuture Advisory Votes on the AbilityCompensation of Directors to Vote by Proxy at Board Meetingsour Named Executive Officers

Our ArticlesSection 14A of Incorporation currently includethe Exchange Act requires us to submit a provisionnon-binding, advisory resolution to shareholders at least once every six years to determine whether advisory votes on say-on-pay proposals should be held every year, every two years or every three years. Accordingly, shareholders are being asked to vote on the following advisory resolution:

“Resolved, that the shareholders of the Company advise that an advisory resolution with respect to executive compensation should be presented every year, every two years or every three years as reflected by their votes for each of these alternatives in Subpart Fconnection with this resolution.”

In voting on this resolution, you should mark your proxy for every year, every two years or every three years based on your preference as to the frequency with which an advisory vote on executive compensation should be held. If you have no preference, you should abstain.

The optimal frequency of Article V, which allowsthe vote necessarily is based on a memberjudgment about the relative benefits and burdens of our Boardeach of Directorsthe options. There are different views as to take action by proxy at a meeting ofthe best approach and the Compensation Committee and the Board of Directors orrecognize that there is a meeting of any of its committees at which the director is not in attendance. The Board of Directors recommend that this provision be deleted in its entirety in order to further strengthen the Company’s corporate governance practices and to also make the Articles of Incorporation reflect the practices of our Board of Directors.

The current proxy language in Subpart F of our Articles of Incorporation is supported by Louisiana corporate law which allows for directors to vote at a meeting by proxy only if specifically authorized by a corporation’s articles of incorporation. As a result, removing Subpart F of Article V from our Articles of Incorporation will eliminate the ability of our directors to vote by proxy at Board and Committee meetings in which they are not in attendance.

Our Board of Directors encourages each of its members to attend and participate in Board and committee meetings as evidenced by the attendance rate of our Board members. Each member of our Board of Directors attended at least 81% and 78%, respectively, of the Board and respective committee meetings held in 2010. We believe that it is importantreasonable basis for each of the Board membersoptions.

Some believe that a less frequent vote would: (i) permit shareholders to participatefocus on overall design issues rather than on the details of individual decisions, (ii) align with the goals of our compensation arrangements which are designed to reward performance that promotes long-term shareholder value, and (iii) avoid the burdens that annual votes would impose on shareholders required to evaluate the compensation programs of a large number of companies each year.

Others believe that an annual vote affords shareholders: (i) the opportunity to react promptly to emerging trends in compensation, (ii) provides feedback before those trends become pronounced over time, and (iii) gives the discussions that take place at meetings prior to casting their vote on a matter. By granting a proxy in advance of such discussions, directors may not have additional information presented atCompensation Committee and the meeting or arising from Board discussions that could be material to a director’s voting decision. Further, the Board is not aware of any time in the recent past where a Board member voted by proxy at a meeting at which he or she could not attend.

As a result, our Board of Directors has determinedan opportunity to evaluate individual compensation decisions each year in light of ongoing feedback from shareholders.

After careful consideration of this matter, the Compensation Committee and the Board of Directors believe that, initially, the proposed amendment to remove Subpart FBoard should solicit an annual vote from our shareholders. While not binding, the Board of Article V fromDirectors and the ArticlesCompensation Committee will consider the non-binding vote of Incorporation is desirable andour shareholders on this resolution when reviewing the frequency with which an advisory vote on executive compensation should be held in the Company’s and our shareholders’ best interest.future.

Approval of the proposed amendments to Subpart F of Article V requires the affirmative vote of a majority of the total number of votes that are present (in person or by proxy) and entitled to vote on this proposal at the Annual Meeting. If approved by shareholders at the Annual Meeting, the amendment to Subpart F will become effective upon the filing of the Amended and Restated Articles of Incorporation with the Louisiana Secretary of State, and we expect to make such filing promptly after approval by our shareholders at the Annual Meeting.

Approval of this Item 3 is separate from the approval required with respect to amendment proposed in Item 4 to modify the process by which shareholders may nominate a candidate for election as a director of the Company. The results of the vote on Item 4 will have no impact on the action taken under this Item 3.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”FOR EVERY “1-YEAR” WITH RESPECT TO THE PROPOSAL TO AMEND OUR ARTICLESON THE FREQUENCY OF INCORPORATION TO ELIMINATE THE ABILITYAPPROVAL OF DIRECTORS TO VOTE BY PROXY AT BOARD AND COMMITTEE MEETINGS.

Item 4. Proposal to Amend Our Articles of Incorporation to Modify the Procedures for Shareholder Nominations of Directors

We are requesting that our shareholders approve an amendment to our Articles of Incorporation to modify the criteria and procedures for shareholders to nominate candidates for election to our Board of Directors. We believe the proposed changes, as described below, will bring our shareholder nomination standards more in line with the rules recently adopted by the United States Securities and Exchange Commission (the “SEC”).

In August 2010, the SEC adopted final rules commonly referred to as “proxy access” rules addressing, among other things, shareholder nominations of director candidates. The proxy access rules give shareholders and shareholder groups who have collectively held both investment and voting power of at least 3% of the voting power of a company’s securities continuously for at least three years the right to include information in a company’s proxy statement regarding a shareholder nominated director candidate by complying with certain advanced notice and informational requirements. Originally, the SEC’s proxy access rules were to be effective in November 2010, however the proxy access rules are currently stayed pending the resolution of judicial review. It is unclear at this time if, or when, the stay will be lifted on the SEC’s proxy access rules.

Even though the SEC’s proxy access rules do not directly address the director nomination process and are currently stayed, we believe that the criteria set forth in the proxy access rules provides a useful benchmark for the appropriate standards with respect to shareholder nominations. Such standards reflect a thoughtful balance between allowing shareholders the ability to nominate qualified candidates that they support, helping protect the Company from potential unwanted takeover attempts and limiting the amount of time and resources that must be spent by the Company reviewing any such nominations to ensure compliance and adequate qualifications of the nominees.

The Company’s shareholder nomination process is currently addressed in Subpart H of Article IV of the Company’s Articles of Incorporation. This proposal would amend Subpart H to more closely align the Company’s shareholder nomination requirements with those included in the recently adopted proxy access rules. The material changes to the nominations procedures would include the following:

Share ownership. Unless otherwise required by law, the nominating shareholder individually, or together with a nominating shareholder group, must hold at least 3% of the total voting power of the Company’s securities that are entitled to be voted on the election of directors. In addition, such securities must have been held continuously for at least three years as of the date the notice of such nomination and must continue to be held through the date of the subject election of directors. Subpart H does not currently include a minimum share ownership provision either in number of shares or time held. We believe that the 3% minimum and three year holding requirement preserve shareholder access to the nomination process but help reduce the likelihood of nominations from individuals or groups interested only in short-term results. Under our current provisions, an activist group holding as little as a single share in the Company would have the ability to nominate a director for election even if such share was bought for the sole purpose of making a nomination. Such nomination, even though not well intentioned, would still require the Company to expend the

resources necessary to ensure such nomination met the minimum qualification standards and potentially engage in a proxy fight if such group decided to solicit proxies for its nominee. We believe that the 3% requirement remains low enough that it will not be a significant impediment to the shareholder nomination process. In reaching this conclusion, we note that the 3% threshold is less than the 5% ownership currently required under Louisiana law for shareholders to even obtain a copy of the Company’s shareholder list.

The holding requirement eliminates the ability of an investor or group to acquire shares for the sole purpose of making an immediate director nomination. In addition, as amended, the provisions will require that any shareholder or group that makes a nomination must confirm that he, she or they are not holding any of the Company’s securities with the purpose, or with the effect, of changing control of the Company. We believe this requirement, which is not currently in the Articles of Incorporation, will serve as a deterrent from possible unwanted takeover attempts of the Company through seizure of control of the Board.

Independence. As proposed, new Subpart H would require any shareholder nominee to meet the objective criteria for “independence” of the national securities exchange or national securities association rules applicable to the Company, if any. Our stock is currently listed on the NYSE Amex which requires that a majority of our directors be independent under the NYSE Amex listing standards. In addition to this listing requirement, we believe it is good corporate practice to limit the number of non-independent directors, such as members of management, who serve on the Board. Independent directors help ensure that the best interests of shareholders are taken into consideration in all Board actions. Subpart H does not currently include an independence requirement in connection with the nomination process.FUTURE NON-BINDING ADVISORY SAY-ON-PAY RESOLUTIONS.

Time period for delivery of nominations. As proposed, a nominating shareholder or group would be required to provide nomination to the Company no earlier than 150 calendar days, and no later than 120 calendar days, before the anniversary of the date that we mailed our proxy materials for the prior year’s Annual Meeting, except that, if we did not hold an Annual Meeting during the prior year, or if the date of the meeting has changed by more than 30 days from the prior year (or if we are holding a special meeting or conducting an election of directors by written consent) then such nomination must be transmitted to us within a reasonable time before we mail proxy materials for such meeting. The purpose of this provision is to allow the Board sufficient time to review any nominations received to ensure they meet the standards under our Articles of Incorporation, our director qualification policies then in effect and to determine whether or not the Board will recommend shareholders vote for the election of such nominee. Currently, shareholder nominations must only be received by January 15 of each year unless we call an Annual Meeting for a date after May 31, in which case the shareholder’s notice must be delivered no later than the close of business on the tenth day following the day on which notice of the date of the Annual Meeting was given. We believe setting a deadline for delivering nominations tied to the prior year’s meeting is more appropriate for a public company like ours given the time required to review any nominations received. In addition, this revised deadline will provide the Board more flexibility in setting the date for our Annual Meeting while still providing shareholders with a specific timeframe for delivery of any nominations.

Information regarding the nominating shareholder and the nominee. As is currently the case under Subpart H of Article IV, notice of proposed nominations must still include certain information with respect to the nominating shareholder or group, as well as the proposed nominee. Such informational requirements have been modified in the proposed amendment to Subpart H to further clarify what information is required and to include certain confirmations on the part of the nominating shareholder or group.

The foregoing summary of the proposed changes to Subpart H of Article IV is not complete and is qualified in its entirety to the full text of the proposed revisions which are included in Annex A to this proxy statement. Shareholders are encouraged to carefully read the full text of the proposed amendments prior to voting on this matter.

It is important to note that while the proposed amendments to the shareholder nomination provisions in the Articles of Incorporation are based on the standards included in the SEC’s recently adopted proxy access rules, compliance with the provisions of Subpart H, as amended, will not automatically result in a shareholder nomination being included in the Company’s proxy materials. As with current Subpart H, the revised provisions relate only to a shareholder’s ability to make nominations for presentment at a meeting in which directors are to be elected. Shareholders who wish to have their nominee included in the Company’s proxy materials or to solicit proxies on behalf of their nominee must still follow the applicable rules of the SEC with respect to the solicitation of proxies.

The director nomination process is important to the Company. For more information regarding the process that our Corporate Governance and Nominating Committee goes through prior to recommending director candidates see “Corporate Governance - Director Nominations” in this Proxy Statement. Given the importance of the director nomination process, our Board of Directors believes that it is in the best interest of the Company and our shareholders to revise the standards by which our shareholders may directly nominate director candidates outside of the Corporate Governance and Nominating Committee as described herein.

If the proposed amendment is passed, shareholders will still be welcome to submit their recommendations for director candidates to our Corporate Governance and Nominating Committee for consideration; however, only shareholders that satisfy the criteria contained in the proposed amendment above, will be entitled to directly nominate a director candidate at any meeting in which directors are to be elected.

For the foregoing reasons, our Board of Directors has determined that the proposed amendment to Subpart H of Article IV of the Articles of Incorporation is desirable and in the Company’s and shareholders’ best interest.

Approval of the proposed amendment to Subpart H of Article IV requires the affirmative vote of a majority of the total number of votes that are present (in person or by proxy) and entitled to vote on this proposal at the Annual Meeting. If approved by shareholders at the Annual Meeting, the amendment to Subpart H of Article IV of the Articles of Incorporation will become effective upon the filing of Amended and Restated Articles of Incorporation with the Louisiana Secretary of State,

and we expect to make such filing promptly after approval by our shareholders at the Annual Meeting.

Approval of this Item 4 is separate from the approval required with respect to amendment proposed in Item 3 to eliminate the ability of directors to act by proxy at any meeting of the Board of Directors or a committee thereof. The results of the vote on Item 3 will have no impact on the action taken under this Item 4.

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE PROPOSAL TO AMEND OUR ARTICLES OF INCORPORATION TO AMEND SUBPART H OF ARTICLE IV REGARDING BOARD NOMINATIONS.

Item 5.4. Such other matters as may properly come before the meeting or any adjournments

The Board of Directors knows of no other matters to be brought before the shareholders at the meeting. If other matters are presented for a vote at the meeting, the proxy holders will vote shares represented by properly executed proxies as directed by the Board of Directors. At the meeting, management will report on our business and shareholders will have the opportunity to ask questions.

Corporate Governance

Shareholder, Board and Committee Meetings. During 2010The following chart details the composition of the current Board and its committees and also includes the number of Directors had 15 meetings andheld by each directorgroup in 2011.

| | | | | Committees of the Holding Company Board |

| Director | Independent Director | Holding Company Board | Bank Board | Audit | Compensation | Exec | Corp Gov & Nom |

| Will Charbonnet Sr. | Yes | Chair | Chair | Member | Chair | Chair | Member |

| James R. Davis Jr. | Yes | Member | Member | Chair | Member | | |

J.B. Hargroder, M.D. (1) | Yes | Member | Member | | Member | Member | Chair |

| Clayton Paul Hilliard | Yes | Member | Member | Member | | | Member |

| Milton B. Kidd III, O.D. | Yes | Member | Member | Member | | | |

| Timothy J. Lemoine | Yes | Member | Member | | | | |

R. Glenn Pumpelly(2) | Yes | Member | Member | Member | Member | Member | |

| William M. Simmons | Yes | Member | Member | | | | Member |

| Joseph V. Tortorice, Jr. | Yes | Member | Member | | Member | Member | |

| C.R. Cloutier | No | Member | Member | | | Member | |

Gerald G. Reaux, Jr. (3) | No | Vice-Chair | Vice-Chair | | | | |

| Total Members as of 12/31/2011 | 11 | 11 | 5 | 5 | 5 | 4 |

| Number of Meetings Held in 2011 | 13 | 10 | 8 | 7 | 13 | 3 |

| (1) | J. B. Hargroder, M.D. served as Vice Chairman of the Board until May 25, 2011. |

| (2) | R. Glenn Pumpelly was appointed to the Audit Committee on May 25, 2011. |

| (3) | Gerald G. Reaux, Jr. was elected to the Board on May 25, 2011 and was elected Vice Chairman of the Board on that date. |

As set forth in the table, during 2011, all directors, other than Mr. Tortorice, attended at least 75% of the total number of meetings held of the Board of Directors and committees ofany committee on which he or she was a member.serves. While we encourage all Board members to attend the annual shareholder meeting, there is no formal policy as to their attendance. All of our directors attended the 20102011 Annual Meeting.

Board Independence. Each year, our Corporate Governance and Nominating Committee review the relationships that each director has with us and with other parties. Only those directors who do not have any relationships that keep them from being independent within the meaning of applicable NYSE Amex rules and who the Committee finds have no relationships that would interfere with the exercise of independent judgment in carrying out their responsibilities are considered to be “independent directors.” The Committee reviews a number of factors to evaluate independence, including the directors’ relationships with us and our competitors, suppliers and customers; their relationships with management and other directors; the relationships their current and former employers have with us; and the relationships between us and other companies of which they are directors or executive officers. After evaluating these factors, the Committee determined thatall of the directors, other than Messrs. Charbonnet, Davis, Hargroder, Hilliard, Kidd, Lemoine, Pumpelly, SimmonsCloutier and TortoriceReaux, who are employees of the Bank, are independent within the meaning of applicable NYSE Amex and SEC rules.

Director Training. We are committed to the continuing education of our directors to assist them in the execution of the duties as directors of the Company and the Bank. We provide our directors with the opportunity to attend director education programs provided by federal banking regulators, including the Bank’s primary federal regulator, the Office of the Comptroller of the Currency, and other directorial training or educational sessions directed to the due and proper execution of their duties as directors. Such educational training includes presentations to the full Board of Directors, as well as off-site educational and training sessions.

Leadership Structure and Risk Management. The Board believes that our leadership structure, with separate persons serving as our Chairman of the Board and CEO, is in the best interest of our shareholders at this time. We believe this structure recognizes the differences between the two roles.

Our CEO is responsible for setting the strategic direction for the Company and the day-to-day leadership and performance of the Company, while our Chairman of the Board provides guidance to our CEO and sets the agenda and presides over meetings of the full Board of Directors. We believe that the role of a separate Chairman, who is also an outside director, also helps enhance the independent oversight of management of the Company and helps to ensure that the Board is engaged with the Company’s strategy and how well it is being implemented.

In addition to the roles outlined above, the Board takes an active role in overseeing the management, operations, risk and soundness of the Company. The Chairman of the Board and the Audit Committee Chairman serve as voting members of the Special Assets Committee. In addition, the Chairman of the Company’s Audit Committee also chairs the Company’s Risk Committee. The Risk Committee assures that the Company and the Bank maintain an effective system for identifying, measuring, monitoring, and controlling entity wide risk. The Committee also provides for the oversight of the quality and integrity of accounting, financial reporting, risk management, and control practices of the Company. We believe that such active Board participation strengthens the Company’s operations.

Shareholder Communications. Shareholders may communicate directly with the Board or the individual chairmen of committees by writing directly to them at P. O. Box 3745, Lafayette, Louisiana 70502. We will forward, and not screen, any mail we receive that is directed to an individual, unless we believe the communication may pose a security risk.

Code of Ethics. The Board has adopted a Code of Ethics for our directors, officers and employees to promote honest and ethical conduct, full and accurate reporting, and compliance with laws as well as other matters. A copy of the Code of Ethics is posted on the Investor Relations page of our website at www.midsouthbank.com. A printed copy of our Code of Ethics is available to any shareholder that requests it in writing from our Corporate Secretary. In addition, should there be any waivers of or amendments to the Code of Ethics, those waivers or amendments will be posted on our website.

Standing Board Committees. The Board has an Audit Committee, an Executive Committee, a PersonnelCompensation Committee, and a Corporate Governance and Nominating Committee. Each of these committees operates pursuant to a charter. The charters are available on the Investor Relations page of our website at www.midsouthbank.com. A printed copy of each charter is also available to any shareholder that requests it in writing from our Corporate Secretary.

Audit Committee. The responsibilities of the Audit Committee are set forth in our Audit Committee Charter. The Board has made a determination that its members satisfy NYSE Amex’s requirements as to independence, financial literacy and experience. The Board has also determined that it is not clear whether any member of the Audit Committee is an “Audit Committee Financial Expert” within the meaning of SEC Rules,rules, but the Board does not believe that an Audit Committee Financial Expert is necessary in view of the overall financial sophistication of the Audit Committee members.

Executive Committee. The responsibilities of the Executive Committee are set forth in our Executive Committee Charter. Its duties include shareholder relations, Bank examination and SEC reporting.

PersonnelCompensation Committee. The responsibilities of the Compensation Committee, formerly known as the Personnel Committee, are set forth in our PersonnelCompensation Committee Charter. It is responsible for evaluating the performance and setting/approving the compensation of our executive officers and administering our 2007 Omnibus Incentive Compensation Plan.

Corporate Governance and Nominating Committee. The responsibilities of the Corporate Governance and Nominating Committee are set forth in our Corporate Governance and Nominating Committee Charter. It helps the Board to make determinations of director independence, assess overall and individual Board performance and recommend director candidates, including recommendations submitted by shareholders.

Director Nominations. It is the Corporate Governance and Nominating Committee’s policy that candidates for director have high personal and professional integrity, proven ability and judgment, and skills and expertise appropriate for serving the long-term interests of our shareholders. While we have not adopted a written diversity policy with respect to the composition of our Board, when selecting new, non-management candidates to serve on the Board, the Corporate Governance and Nominating Committee seeks directors who will contribute to the diversity of the Board (including diversity of skills, background, and experience) in order to benefit the Board’s deliberations and decisions. The Committee’s process for identifying and evaluating nominees is as follows: (1) in the case of incumbent directors whose terms of office are set to expire, the Committee reviews their service, including the number of meetings attended, level of participation, quality of performance, and any related party transactions with us during the applicable time period; and (2) in the case of new director candidates, appropriate inquiries into their backgrounds and qualifications are made after considering the needs of the Board. The Committee meets to discuss and consider such candidates’ qualifications, including whether the nominee is independent within the meaning of NYSE Amex rules, and then recommends a candidate to the Board. In seeking potential nominees, the Committee uses its and management’s network of contacts to compile a list of potential candidates, but may also engage, if it deems appropriate, a professional search firm, although to date it has not done so.

The Committee will consider director candidates nominated by shareholders who follow the procedures set out in Article IV (H) of our Articles described under “Item 1. Election of Directors” in this Proxy Statement orIncorporation. In order to nominate a candidate for election as sucha director, pursuant to Article IV (H) may, unless otherwise required by law, the nominating shareholder individually, or together with a nominating shareholder group, must hold at least 3% of the total voting power of the Company’s securities that are entitled to be amendedvoted on the election of directors. In addition, such securities must have been held continuously for at least three years as of the date the notice of such nomination and must continue to be held through the date of the subject election of directors. In addition, any shareholder or group that makes a nomination must confirm that he, she or they are not holding any of the Company’s securities with the purpose, or with the effect, of changing control of the Company. Further, any shareholder nominee for election as a director must also meet the objective criteria for “independence” of the NYSE Amex.

Pursuant to Article IV (H), any such shareholder nomination delivered to the Company should include the following:

| · | as to each person whom you propose to nominate: |

| - | his or her name, age, business address, residence address, principal occupation or employment, |

| - | the number of shares of our stock of which the person is the beneficial owner, and |

| - | any other information relating to the person that would be required to be disclosed in solicitations of proxies for the election of directors by Regulation 14A under the Exchange Act; and |

| · | as to the nominating shareholder or nominating shareholder group: |

| - | the name of the shareholder making such nomination, or if a group, the name of each shareholder in such nominating group, |

| - | the business address, or if none, residence of the nominating shareholder or members of a nominating group, |

| - | the number of shares of our stock of which such shareholder or nominating group are the beneficial owner, |

| - | a statement that the nominee, if elected, consents to serve on the Board of Directors, |

| - | the disclosures regarding the director nominee that would be required by Schedule 14A under the Exchange Act, |

| - | a description of any agreements, arrangements or relationships between the nominating shareholder or nominating group giving the notice and the nominee, |

| - | a statement regarding whether the nominating shareholder or any member of the nominating group has been involved in any litigation adverse to the Company or any of its subsidiaries within the past ten years and, if so, a description of such litigation, and |

| - | a statement that, to the best of the nominating shareholder’s or nominating group’s knowledge, such nominee meets the Company’s director qualification standards then in effect. |

Shareholder nominations for election must be provided to the Company no earlier than 150 calendar days, and no later than 120 calendar days, before the anniversary of the date that we mailed our proxy materials for the prior year’s Annual Meeting, except that, if we did not hold an Annual Meeting during the prior year, or if the date of the meeting has changed by more than 30 days from the prior year (or if we are holding a special meeting or conducting an election of directors by written consent) then such nomination must be transmitted to us within a reasonable time before we mail proxy materials for such meeting.

An inspector, not affiliated with us and appointed by our Corporate Secretary, will determine whether the notice provisions described under Item 4. above were met. If they determine that you have not complied with Article IV (H), your nomination will be disregarded. The foregoing is only a summary of the shareholder nomination procedures included in Article IV (H) of our Articles of Incorporation, is not complete and is qualified in its entirety to the full text of Article IV (H). You are encouraged to read the full text of Article IV (H) prior to submitting any nomination for election as a director of the Company.

The Committee will also consider director candidates recommended (but not nominated) by shareholders so long as such recommendations are received at least 120 days before the anniversary date that we mailed our proxy materials for the prior year’s annual meeting. In the event the meeting is moved by more than 30 days from the anniversary of the prior year’s meeting, the Committee will set a new deadline for the receipt of recommendations following the announcement of the new annual meeting date.

The Corporate Governance and Nominating Committee does not intend to alter the manner in which it evaluates candidates, including the criteria set forth above, based on whether the candidate was nominated or recommended by a shareholder or otherwise.

Shareholder Proposals. Eligible shareholders who want to present a proposal qualified for inclusion in our proxy materials for the 20122013 Annual Meeting must forward such proposal to our Secretary at the address listed on the first page of this Proxy Statement in time to arrive before December 24, 2011.

14, 2012. Proxies may confer discretionary authority to vote on any matter for which we receive notice after March 9, 2012,February 27, 2013, without the matter being described in the Proxy Statement for our 20122013 Annual Meeting.

Section 16(a) Beneficial Ownership Reporting Compliance. Section 16(a) of the Securities and Exchange Act of 1934 requires our directors, executive officers and 10% shareholders to file with the SEC initial reports of ownership and reports of changes in ownership of our equity securities, and to furnish us with copies of all the reports they file. On the basis of reports and representation of our directors, executive officers, and greater than 10% shareholders, we believe that each person subject to filing requirements with respect to us timely satisfied all required filing requirements during 2010.2011.

PersonnelCompensation Committee Interlocks and Insider Participation. The PersonnelCompensation Committee is composed entirely of independent directors. None of our executive officers has served on the board of directors or compensation committee (or other committee serving an equivalent function) of any other entity, none of whose executive officers served on our Board of Directors or PersonnelCompensation Committee. None of the members of the PersonnelCompensation Committee was an officer or other employee of our Company or any of our subsidiaries during 2010,2011, or is a former officer or other employee of our Company or any of our subsidiaries.

___________________

SECURITY OWNERSHIP OF MANAGEMENT

AND CERTAIN BENEFICIAL OWNERS

Security Ownership of Management

The following table shows as of March 31, 2011,15, 2012, the beneficial ownership of our common stock by each director, nominee, and each executive officer named in the Summary ofNamed Executive Compensation Table below,Officer, and by all directors, nominees, and executive officers as a group. Unless otherwise indicated, the stock is held with sole voting and investment power.

| Name | Amount and Nature of Beneficial Ownership(1) | Percent of Class |

| Directors and Nominees: | | |

| Will Charbonnet, Sr. | 168,774(1,2) | 1.73% |

| C. R. Cloutier | 404,742(1,3) | 4.10% |

| James R. Davis, Jr. | 78,078(4) | * |

| Karen L. Hail | 102,426(5) | 1.05% |

| J. B. Hargroder, M.D. | 436,912(1,6) | 4.48% |

| Clayton Paul Hilliard | 252,550(7) | 2.59% |

| Milton B. Kidd, III, O.D. | 239,355 | 2.45% |

| Timothy J. Lemoine | 28,803(8) | * |

| R. Glenn Pumpelly | 22,279(1,9) | * |

| Gerald G. Reaux, Jr. | 196 | * |

| William M. Simmons | 223,286(10) | 2.29% |

| Joseph V. Tortorice, Jr. | 114,418(1,11) | 1.18% |

| Named Executive Officers: | | |

| Donald R. Landry | 28,116 | * |

| James R. McLemore | 1,822(12) | * |

| John R. Nichols | 9,047(13) | * |

| All directors, nominees, and executive officers as a group (15 persons) | 2,110,804(14) | 21.36% |

| Name | | Amount and Nature of Beneficial Ownership(1) | | | Percent of Class | |

| Directors and Nominees: | | | | | | |

| Will Charbonnet, Sr. | | | 176,082 | (1,2) | | | 1.66 | % |

| C. R. Cloutier | | | 406,023 | (1,3) | | | 3.82 | % |

| James R. Davis, Jr. | | | 78,956 | (4) | | | * | |

| J. B. Hargroder, M.D. | | | 430,902 | (1,5) | | | 4.05 | % |

| Clayton Paul Hilliard | | | 254,060 | (6) | | | 2.39 | % |

| Milton B. Kidd, III, O.D. | | | 243,581 | (7) | | | 2.29 | % |

| Timothy J. Lemoine | | | 28,972 | (8) | | | * | |

| R. Glenn Pumpelly | | | 31,973 | (1,9) | | | * | |

| Gerald G. Reaux, Jr. | | | 51,000 | (10) | | | * | |

| William M. Simmons | | | 228,428 | (11) | | | 2.15 | % |

| Joseph V. Tortorice, Jr. | | | 120,574 | (1,12) | | | 1.13 | % |

| | | | | | | | | |

| Named Executive Officers: | | | | | | | | |

| Troy M. Cloutier | | | 28,445 | (13) | | | * | |

| James R. McLemore | | | 2,490 | (14) | | | * | |

| John R. Nichols | | | 9,658 | (15) | | | * | |

| All directors, nominees, and executive officers as a group (14 persons) | | | 2,145,871 | (16) | | | 20.18 | % |

_________________________

| * | Less than 1% of the outstanding common stock, based on 9,880,74310,631,830 shares of our common stock issued and outstanding as of March 31, 2011.15, 2012. |

| (1) | Stock held by our Directors’ Deferred Compensation Plan & Trust (the “DDCP”) is beneficially owned by its Plan Administrator, our Executive Committee, the members of which could be deemed to share beneficial ownership of all Stock held in the DDCP (370,857(390,471 shares or 3.75%3.67% as of March 31, 2011)15, 2012). For each director, the table includes the number of shares held for his or her account only, while the group figure includes all shares held in the DDCP. Stock held by our Employee Stock Ownership Plan (the “ESOP”) is not included in the table, except that shares allocated to an individual’s account are included as beneficially owned by that individual. Shares which may be acquired by exercise of options currently exercisable or that they will become exercisable within 60 days of March 31, 201115, 2012 (“Current Options”) are deemed outstanding for purposes of computing the percentage of outstanding Common Stock |

| owned by persons beneficially owning such shares and by all directors and executive officers as a group but are not otherwise deemed to be outstanding. |

| (2) | Includes 51,82658,026 shares as to which he shares voting and investment power. |

| (3) | Includes 221,343229,843 shares as to which he shares voting and investment power. Mr. Cloutier and his wife, Brenda Cloutier, have pledged 15,000 shares to Whitney Bank securing a loan in the amount of $300,000$221,000 with a balance of $192,989$201,738 for their daughter’s daycare business. Additionally, Mr. and Mrs. Cloutier have pledged 6,97916,979 shares to First National Banker’s Bank to secure a personal loan in the amount of $140,045$96,047 with a balance of $57,940.$96,047. |

| (4) | Includes 8,998 shares as to which he shares voting and investment power. Mr. Davis has pledged 27,375 shares to Capital One Investments to secure a $250,000 line of credit with a balance of $235,000$190,018 as well as a securing a $159,658 loan with a balance of $113,650.$85,017. |

| (5) | Includes 1,244 shares as to which she has sole voting and investment power. |

(6) | Includes 380,200382,000 shares as to which he shares voting and investment power. |

(7)(6) | Includes 117,000107,200 shares as to which he has soleshares voting and investment power. Mr. Hilliard has pledged 43,672 shares to MidSouth Bank as partial security on a $1,000,000 line of credit with a balance of $0.00.$150,000. Additionally, Mr. Hilliard has 15,200 shares in his Morgan Stanley account which serves as collateral for his UBS Line of Credit which has an outstanding balance of $528,592.$235,221. |

| (7) | Includes 37,242 shares as to which he shares voting and investment power. |

| (8) | Includes 21,217 shares as to which he shares voting and investment power. |

| (9) | Includes 22,27931,973 shares as to which he shares voting and investment power. |

| (10) | Includes 8,09851,000 shares as to which he shares voting and investment power. |

| (11) | Includes 107,7998,098 shares as to which he shares voting and investment power. |

| (12) | Includes 1,000111,805 shares as to which he has soleshares voting and investment power. |

| (13) | Includes 1,98419,711 shares as to which he has soleshares voting and investment power. |

| (14) | Includes 1,000 shares as to which he shares voting and investment power. |

| (15) | Includes 1,984 shares as to which he shares voting and investment power. |

| (16) | Total reflects 12,40454,727 shares held in the DDCP for the benefit of atwo former directordirectors who hashave not yet received a distribution.distributions. |

_______________________

The following table shows the number of shares in the DDCP (see footnote 1 above) and ESOP, and the number of shares subject to Current Options that have been included in the above ownership table.

| Name | DDCP | ESOP | Current Options |

| Directors and Nominees: | | | |

| Will Charbonnet, Sr. | 52,736 | -- | -- |

| C. R. Cloutier | 64,215 | 34,440 | 19,998 |

| James R. Davis, Jr. | 41,707 | -- | -- |

| Karen L. Hail | 41,186 | 58,354 | -- |

| J. B. Hargroder, M.D. | 56,712 | -- | -- |

| Clayton Paul Hilliard | 23,988 | -- | -- |

| Milton B. Kidd, III, O.D. | 18,922 | -- | -- |

| Timothy J. Lemoine | 7,586 | -- | -- |

| R. Glenn Pumpelly | -- | -- | -- |

| Gerald G. Reaux, Jr. | -- | -- | -- |

| William M. Simmons | 54,361 | -- | -- |

| Joseph V. Tortorice, Jr. | 6,619 | -- | -- |

| Named Executive Officers: | | | |

| Donald R. Landry | -- | 28,116 | -- |

| James R. McLemore | -- | -- | -- |

| John R. Nichols | -- | 3,256 | 1,313 |

_______________________| Name | | DDCP | | | ESOP | | | Current Options | |

| Directors and Nominees: | | | | | | | | | |

| Will Charbonnet, Sr. | | | 53,844 | | | | -- | | | | -- | |

| C. R. Cloutier | | | 65,562 | | | | 35,875 | | | | 9,998 | |

| James R. Davis, Jr. | | | 42,585 | | | | -- | | | | -- | |

| J. B. Hargroder, M.D. | | | 57,902 | | | | -- | | | | -- | |

| Clayton Paul Hilliard | | | 24,498 | | | | -- | | | | -- | |

| Milton B. Kidd, III, O.D. | | | 19,326 | | | | -- | | | | -- | |

| Timothy J. Lemoine | | | 7,755 | | | | -- | | | | -- | |

| R. Glenn Pumpelly | | | -- | | | | -- | | | | -- | |

| Gerald G. Reaux, Jr. | | | -- | | | | -- | | | | -- | |

| William M. Simmons | | | 55,503 | | | | -- | | | | -- | |

| Joseph V. Tortorice, Jr. | | | 8,769 | | | | -- | | | | -- | |

| | | | | | | | | | | | | |

| Named Executive Officers: | | | | | | | | | | | | |

| Troy M. Cloutier | | | -- | | | | 5,569 | | | | 3,118 | |

| James R. McLemore | | | -- | | | | 668 | | | | -- | |

| John R. Nichols | | | -- | | | | 3,824 | | | | 1,313 | |

Security Ownership of Certain Beneficial Owners

The following lists the only persons known to us as of March 31, 201115, 2012 to beneficially own more than five percent of our Stock.

| | Common Stock Beneficially Owned as of Record Date |

Name and Address Of Beneficial Owner | Amount | Percent of Class |

MidSouth Bancorp, Inc., Employee Stock Ownership Plan, ESOP Trustees and ESOP Administrative Committee(1) P. O. Box 3745, Lafayette, LA 70502 | 584,109 | 5.91% |

| | | |

Sy Jacobs/Jacobs Asset Management, LLC 11 East 26 Street New York, New York 10010 | 605,841 | 6.13%(2) |

| | | |

Lord, Abbett & Co., L.L.C. 90 Hudson Street Jersey City, NJ 07302 | 512,653 | 5.19%(3) |

_________________________| | | Common Stock Beneficially Owned as of Record Date | |

Name and Address Of Beneficial Owner | | Amount | | | Percent of Class | |

MidSouth Bancorp, Inc., Employee Stock Ownership Plan, ESOP Trustees and ESOP Administrative Committee(1) P. O. Box 3745, Lafayette, LA 70502 | | | 564,428 | | | | 5.31 | % |

| | | | | | | | | |

Sy Jacobs/Jacobs Asset Management, LLC 11 East 26 Street New York, New York 10010 | | | 594,675 | | | | 5.59 | %(2) |

| (1) | The Administrative Committee directs the Trustees how to vote the approximately 7,890 unallocated shares in the ESOP as of March 31, 2011. Voting rights of the shares allocated to ESOP participants’ accounts are passed through to them. The Trustees have investment power with respect to the ESOP’s assets, but must exercise it in accordance with an investment policy established by the Administrative Committee. The Trustees are Irving Boudreaux, Regional President, and Bernie Parnell and Susan Benoit, two Bank officers.officer. The Administrative Committee consists of three Bank officers Marla Napier,Brenda Thibeaux, Monique Bradberry, and Susan Davis, Senior Accounting Supervisor. |

| (2) | Percentage is as of record date. Share ownership percentage as of December 31, 20102011 was 6.23%5.68%. As reported on Schedule 13G/A dated February 14, 2011,2012, Sy Jacobs/Jacobs Asset Management, LLC, has shared voting power and shared dispositive power with respect to the shares. |

(3) | Percentage is as of record date. Share ownership percentage as of December 31, 2010 was 5.27%. As reported on Schedule 13G dated February 14, 2011, Lord Abbett & Co., LLC, has sole voting power with respect to 425,353 shares and sole dispositive power with respect to 512,653 shares. |

_________________________

Certain Relationships and Related Transactions

Directors, nominees, executive officers and their associates have been customers of, and have borrowed from MidSouth Bank in the ordinary course of business, and such transactions are expected to continue in the future. Any loans or other extensions of credit made by the Bank to such individuals were made in the ordinary course of business on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with unaffiliated third parties and did not involve more than the normal risk of collectability or present other unfavorable features.

We have adopted a formal policy with respect to the approval of related party transactions, other than our policies with respect to the approval of loans made to directors and executive officers. Pursuant to this policy, the Audit Committee (or with respect to compensation matters, the PersonnelCompensation Committee) will review and, if appropriate, approve any transaction in which the Company is or will be a party of and in which the amount exceeds $120,000, and in which any of the Company’s directors, executive officers or significant shareholders had, has or will have a material interest. Such transactions will only be approved if they are deemed to be in the best interest of the Company and its shareholders.

_________________________

COMPENSATION DISCUSSION AND ANALYSIS

The following Compensation Discussion and Analysis (“CD&A”) may contain statements regarding current and future theindividual and Company performance targets and/or goals. We have disclosed this information in the limited context of our compensation programs; therefore, these statements should not be interpreted to be management’s expectations or estimates of results or other guidance. We specifically caution investors not to apply such statements to other contexts.

ThisExecutive Summary

We have prepared this CD&A is intended to assist you in understanding our compensation programs. It is intended to explain the philosophy underlying our compensation strategy and the fundamental elements of the compensation we paid to our Chief Executive Officer, Chief Financial Officer, and other individuals included in the Summary Compensation Table (Named Executive Officers or “NEOs”) for 2010. It is2011. Our compensation programs have been designed to reward performance in order to align the intentNEO’s interests with that of our shareholders. Given our operation in the Company tohighly-regulated banking industry, our compensation programs must also comply with all regulations related tothe executive compensation disclosures outlined by federal agencies that oversee our operations, including but not limited to, the SEC,Board of Governors of the Federal Reserve System, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation (“FDIC”). In recent years, including 2011, such regulations have provided us with less flexibility in establishing our compensation programs than what others in general industry may experience.

Our 2011 financial performance was and continues to be, significantly impacted by the disruptions in the national economy and the resulting financial uncertainty that has severely affected the banking industry. While we believe our market areas have fared better than the national economy during this most recent economic downturn, the economic uncertainty and difficult real estate markets had an impact on our loan losses, loan demand and our net interest margin. Despite these challenges, we continued to grow our franchise and expand our footprint in 2011.

Highlights for 2011 include:

| · | Completion of three acquisitions that resulted in the Bank acquiring over $127.8 million in loans and the assumption of over $349.6 million in deposits. |

| · | The acquisitions completed in 2011 allowed us to greatly expand our Texas footprint, including into the Dallas-Fort Worth market, while also enhancing our presence in Louisiana. |

| · | In August 2011, we repaid $20.0 million in TARP funds through our participation in the U.S. Treasury’s Small Business Lending Fund (“SBLF”) which also resulted in an additional $12.0 million in capital for the Bank. As a result, of our repayment of the TARP funds, we are no longer subject to the compensation limitations imposed under TARP. |

| · | Total assets increased to $1.4 billion, total loans increased to $746.3 million and total deposits increased to $1.2 billion. |

We believe our strong capital base and solid financial condition at December 31, 2011 will facilitate our future growth in 2012. This strategic direction and our 2011 accomplishments formed an important basis for the Compensation Committee’s executive compensation decisions for 2012.

Overview of Elements of Compensation

Historically we have used the following elements as part of our compensation program for our executive officers:

| · | Base Salary – Fixed base pay reflective of each officer’s position, individual performance, experience, and expertise. While not at risk like incentive compensation, increases in base salary are also tied to our performance. |

| · | Annual Incentives – Generally cash awards based upon the achievement of defined performance targets under the Company’s 2011 Annual Incentive Compensation Plan (“AICP”). |

| · | Equity-based Awards – We have the ability to grant equity incentive awards under our 2007 Omnibus Incentive Plan to encourage and reward long-term performance. |

| · | Discretionary Bonus Awards – Payment of discretionary bonuses provide flexibility to reward levels of performance that might not otherwise be reflected in other established incentive awards. |

| · | Retirement Benefits – Includes the ESOP, 401(k) retirement plan, and, with respect to C.R. Cloutier, the Executive Indexed Salary Continuation Agreement. |

| · | Other Compensation – Certain executives also receive additional benefits and perquisites such as split dollar life insurance, supplemental term life insurance, supplemental disability insurance, company car, moving expenses, uniform allowance, cell phone, Board of Director fees, and club memberships. |